Cryptocurrency is changing finance in many ways, and one of the most interesting is crypto lending (Earning and Borrowing Crypto). Traditional banks often charge high fees and interest rates when lending money. In contrast, crypto lending platforms like Nexo offer a different approach that could benefit many users. This guide will explain what Nexo is, how it works, and how to get started.

Table of Contents

What is Nexo?

Nexo is a widely recognized crypto lending platform that enables users to earn interest on their digital assets, borrow funds using their cryptocurrencies as collateral, and even use a Nexo-branded credit card for everyday purchases. Nexo’s approach is advantageous because it allows users to access liquidity while retaining ownership of their crypto holdings, which may appreciate in value over time.

The platform supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, and many altcoins, making it a versatile choice for diverse investment portfolios. The platform also employs robust security measures to safeguard user assets, including insurance coverage for digital assets and advanced encryption protocols. This focus on security, combined with a streamlined interface, ensures that users can manage their crypto assets with confidence and ease.

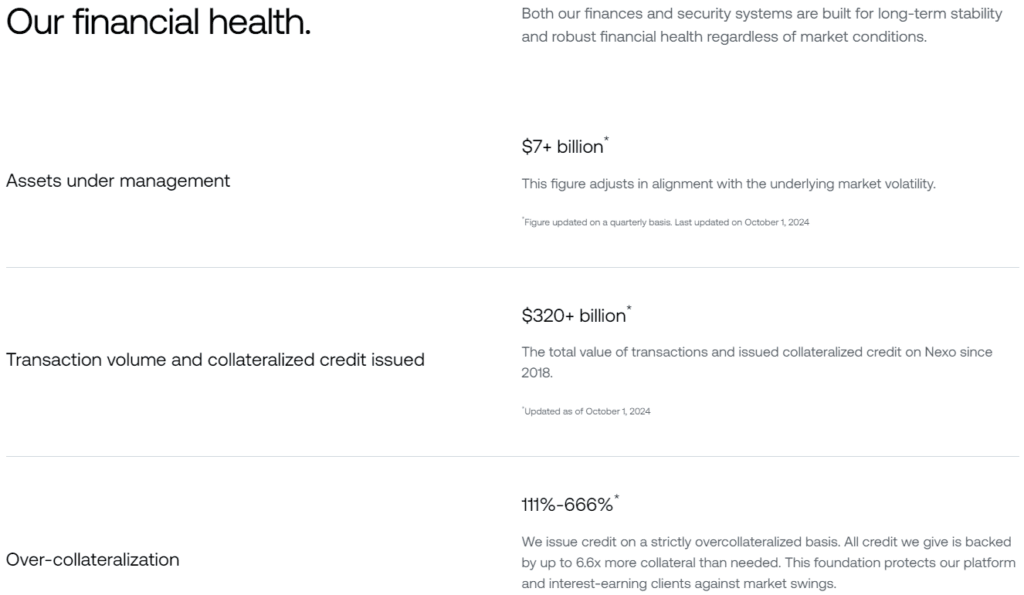

As of 2024, Nexo managed over $7 billion in assets, facilitated transactions and collateralized credit totaling more than $320 billion, and paid over $1 billion in interest to its users. The platform strictly adheres to an over-collateralization model, ensuring that credit is issued only on a fully collateralized basis to safeguard both the platform and its interest-earning clients from market fluctuations.

Why Borrow from Nexo?

There are a few reasons why borrowing from Nexo can be helpful:

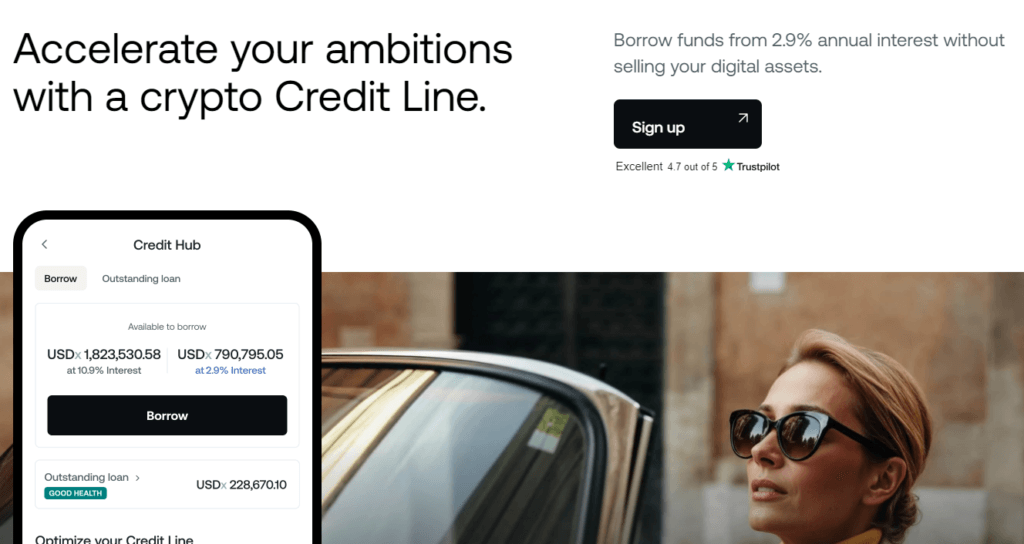

- Access to Funds Without Selling Assets: If you need funds for a major purchase, such as a car or a house, selling your crypto may not be the best option. Instead, consider using your crypto as collateral. This method allows you to access the necessary funds from 2.9% annual interest while still holding onto your crypto, which could appreciate in value over time.

- No Credit Checks: Traditional lending often involves credit checks, which can be a hassle if you have a less-than-perfect credit history. Crypto lending only requires collateral, simplifying the process.

How to Get Started with Nexo and Borrow Funds

Starting with Nexo is relatively easy. Here are the steps:

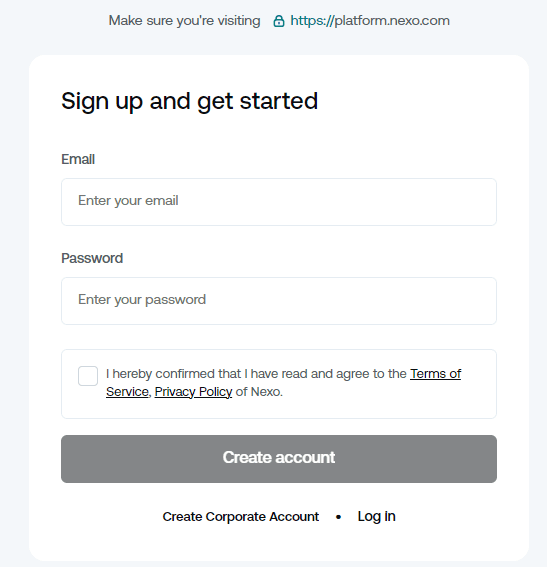

1. Create an Account:

Visit the Nexo website using the link below and create an account. Verify your email, then proceed to log in to your Nexo account.

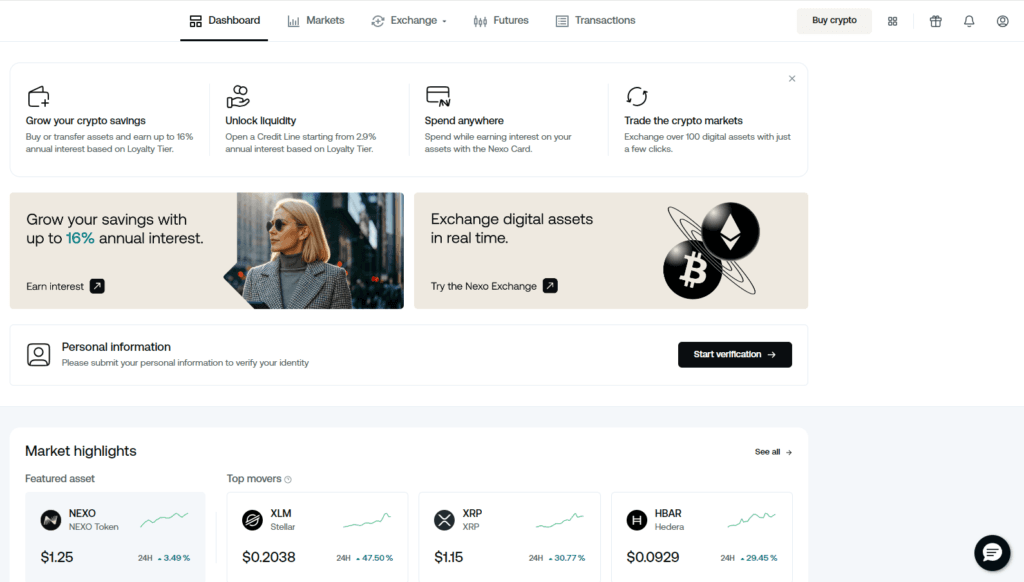

Nexo Dashboard

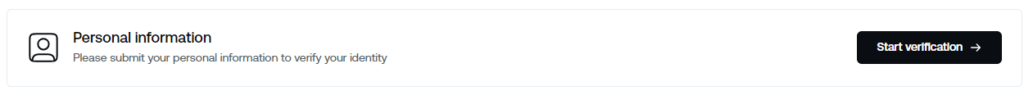

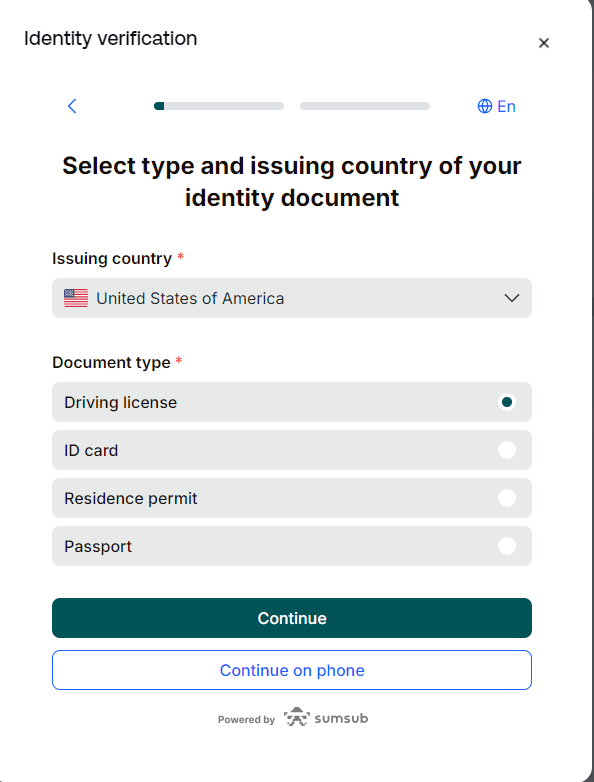

- Next, provide your personal information to initiate the KYC Verification Process. You’ll need to verify your identity by providing a government-issued ID. This process is quick and automated.

- Proceed to identity verification by selecting “Continue on Phone,” as it is easier and faster.

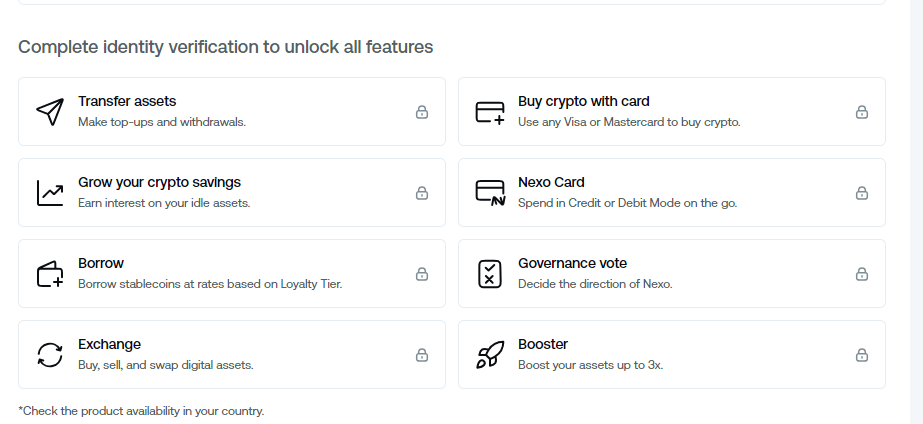

- The process should take less than two minutes, and once completed, it will grant you access to all the features of Nexo.

2. Deposit Crypto:

Nexo supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, and many altcoins. Make sure to choose one and deposit it.

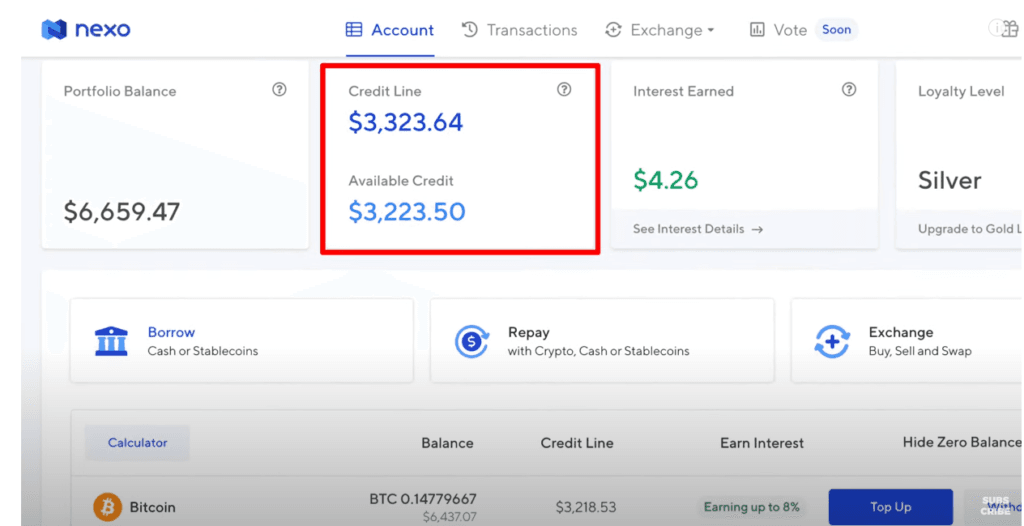

3. Borrow and Withdraw Your Loan Funds:

Once your account is verified and your deposit has been made, you can select how much you want to borrow and receive your funds instantly. Depending on the amount you wish to borrow, you will need to secure funds as collateral. The collateral required must be twice the value of the amount you intend to borrow.

For example, if you want to borrow $10,000 for a car, you would need to lock up at least $20,000 worth of Bitcoin, following a 50% loan-to-value ratio. This means you have to guarantee that Nexo can sell your locked crypto to get its money back if you can’t pay back the loan.

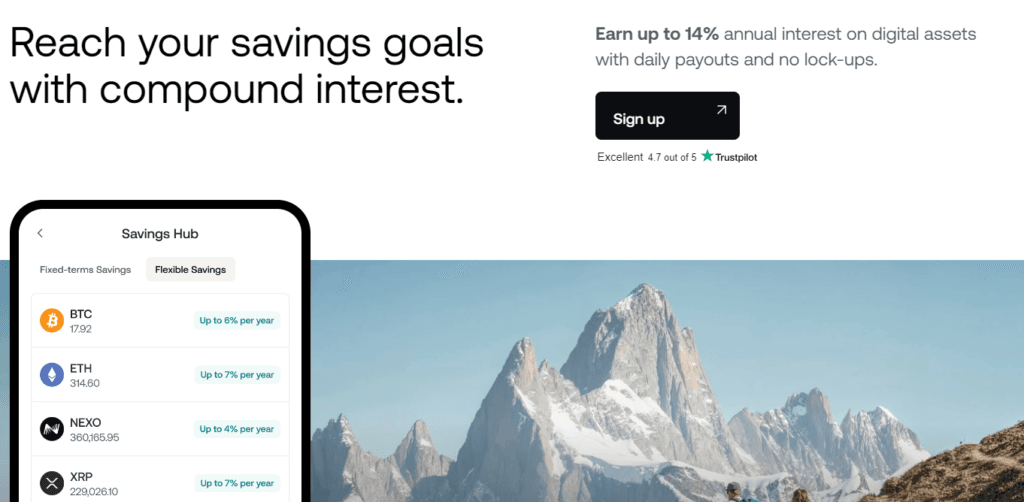

Earning Interest with Nexo

If you choose not to borrow but want to earn money from your crypto, depositing your funds with Nexo is an option. The platform offers interest rates of up to 14% per annum (p.a.) on digital assets, with daily payouts and no lock-up periods. This means you can withdraw the earned interest daily, allowing you to earn from your crypto holdings over time.

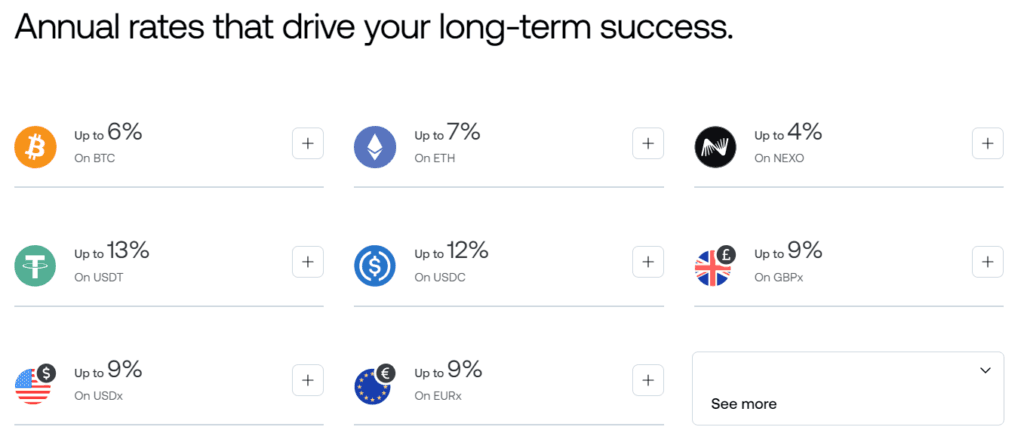

The interest rate you receive depends on the type of currency you hold.

You can even boost your interest rate up to 28% annual percentage yield (APY) through three methods:

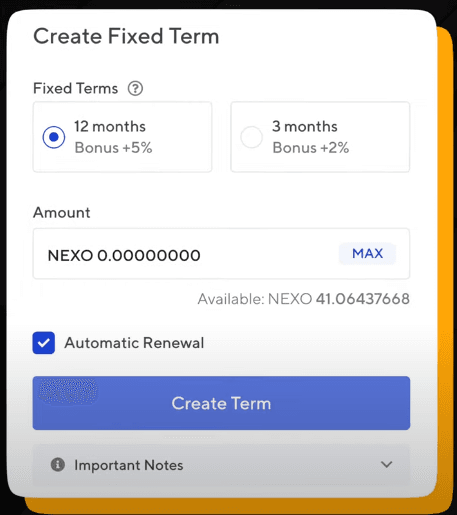

1. Fixing Terms: Lock up your cryptocurrency for a specific period.

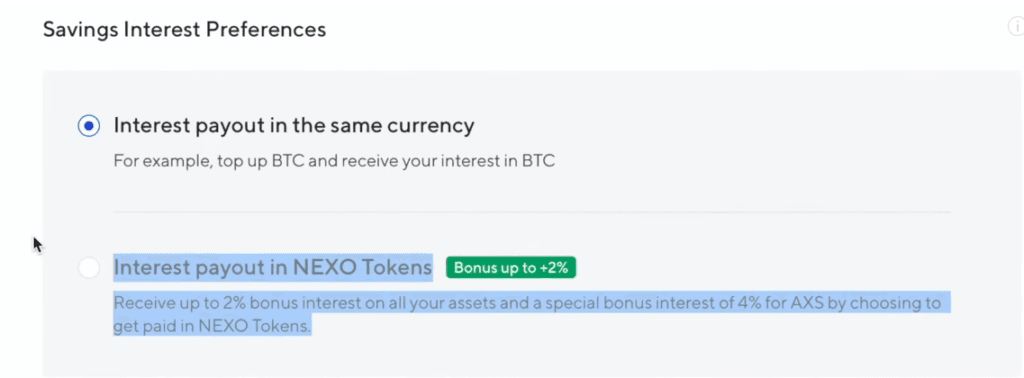

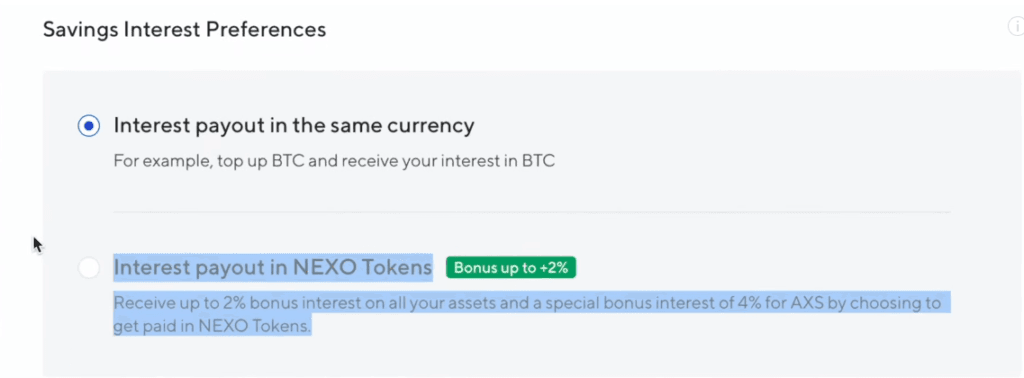

2. Nexo Token Payments: Choose to receive your interest payments in Nexo’s native token.

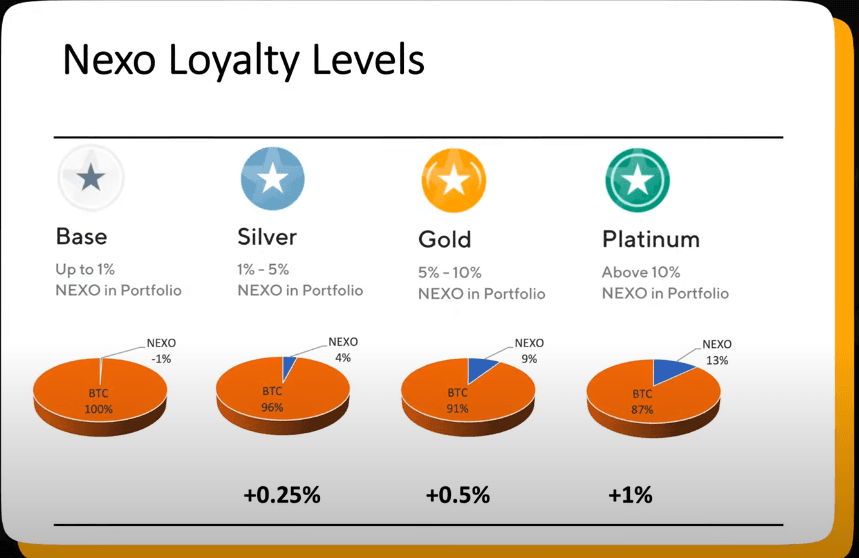

3. Loyalty Level: Hold a certain amount of Nexo tokens in your portfolio to increase your interest rate.

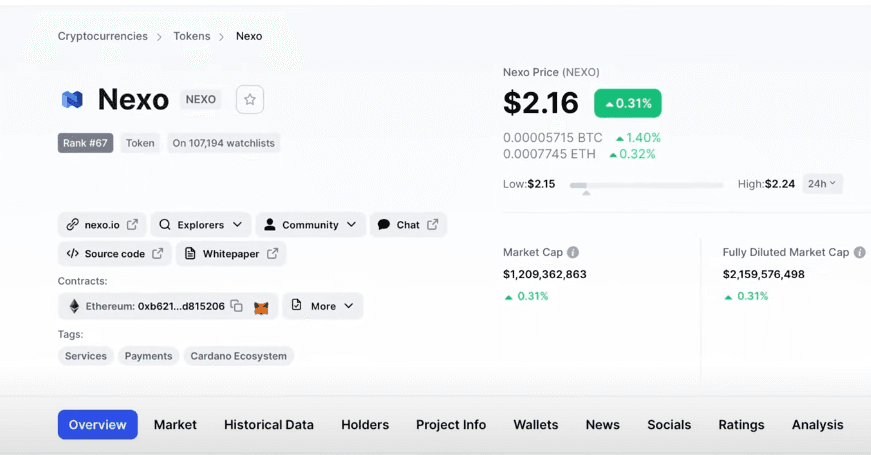

Nexo Tokens

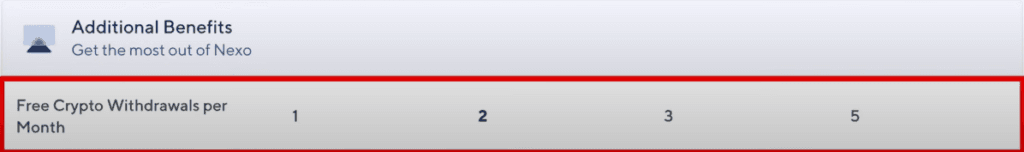

Nexo has its own type of token called the Nexo Token. This is a special token that comes with benefits. By holding Nexo tokens, users receive dividends based on the platform’s profits, along with discounts on loan interest and a certain number of free withdrawals each month. If you opt to get paid in Nexo tokens, you could earn up to 2% more interest.

Conclusion

Nexo is a solid option for those looking to earn passive income through interest on their cryptocurrency or needing to borrow funds without selling their assets. However, it’s wise to spread your investments across multiple platforms to minimize risk.

Whether you’re looking to take out a loan or earn interest on your crypto, Nexo offers features that could meet your needs while keeping your assets secure.