If you’re exploring options for managing and maximizing your cryptocurrency assets, a Nexo review is essential. Nexo has emerged as a prominent platform in the crypto finance world, offering a range of services designed to help users leverage their digital assets effectively. From crypto lending and earning interest to using a crypto-backed credit card, Nexo provides a suite of features aimed at enhancing your financial flexibility. In this review, we’ll delve into Nexo’s services, user experience, pricing, and more to help you determine if it’s the right fit for your investment strategy.

Table of Contents

What is Nexo?

Nexo is a prominent player in the crypto finance space, offering a suite of services designed to help users maximize the value of their digital assets. Founded in 2018, Nexo has quickly established itself as a leading platform for crypto lending, borrowing, and earning interest on cryptocurrencies.

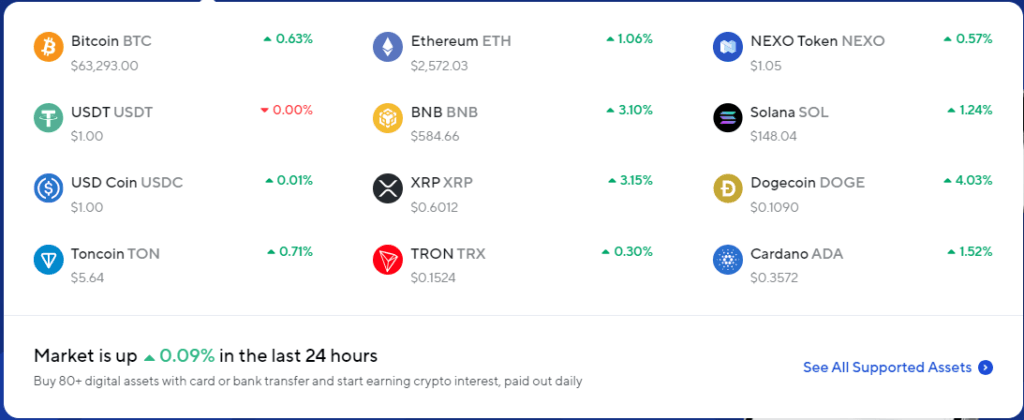

At its core, Nexo provides a unique blend of services that cater to both seasoned crypto investors and newcomers. Users can leverage their cryptocurrency holdings to secure loans, earn interest on their assets, and even use a Nexo-branded credit card for everyday purchases. The platform supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, and many altcoins, making it a versatile choice for diverse investment portfolios.

Nexo’s approach is built on security and user-friendly design. The platform employs robust security measures to safeguard user assets, including insurance coverage for digital assets and advanced encryption protocols. This focus on security, combined with a streamlined interface, ensures that users can manage their crypto assets with confidence and ease.

Summary of Nexo’s Key Strengths

- Crypto Lending: Offers competitive loan-to-value ratios, allowing users to borrow against their crypto assets without selling them.

- High-Interest Rates: Provides attractive interest rates on deposits, enabling users to earn passive income on their cryptocurrencies and fiat currencies.

- User-Friendly Interface: Features an intuitive platform that is easy to navigate for both beginners and experienced users.

- Wide Range of Supported Assets: Supports a diverse selection of cryptocurrencies, giving users flexibility in managing their portfolios.

- Instant Credit Lines: Users can access credit instantly without lengthy approval processes.

- Nexo Card: Allows users to spend their crypto assets seamlessly in real-time without needing to convert them into fiat first.

- Security Measures: Implements robust security protocols, including cold storage and insurance on assets, to protect user funds.

Why Consider Nexo?

- Convenience: Nexo combines multiple financial services into one platform, making it easier for users to manage their crypto investments.

- Growth Potential: By offering innovative financial products, Nexo allows users to leverage their assets for growth in both the crypto and fiat markets.

- Accessible to All: Whether you’re a seasoned investor or new to crypto, Nexo’s user-friendly design and educational resources cater to all experience levels.

- Passive Income Opportunities: With high-interest rates on deposits, users can maximize their investment potential without active trading.

You should consider trying Nexo for its comprehensive services, security, and the opportunity to earn and manage your crypto assets effectively.

In-Depth Examination of Features and Functionality

Nexo offers a comprehensive range of services designed to meet the needs of cryptocurrency users. The platform stands out for its innovative solutions that allow users to leverage their crypto assets in multiple ways. Here’s a closer look at what Nexo provides:

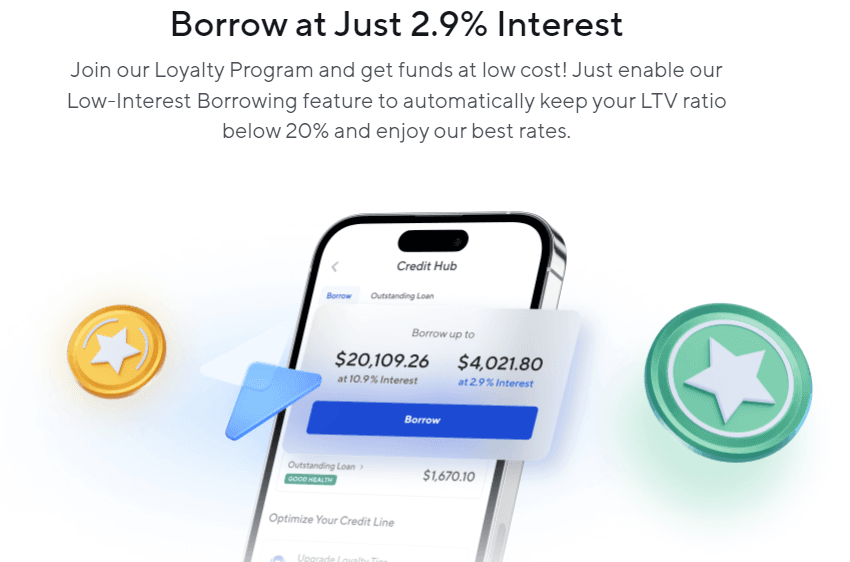

Crypto Lending and Borrowing

One of the core services of Nexo is its crypto lending and borrowing feature. Users can pledge their cryptocurrency holdings as collateral to secure instant loans in fiat currencies or stablecoins. This feature is particularly beneficial for those looking to access liquidity without selling their assets. The loan approval process is quick, and funds can be accessed in as little as 6 hours.

Buy Crypto

Nexo allows users to buy crypto seamlessly and use recurring buys to automate their purchases.

Interest Earning on Crypto Holdings

Nexo allows users to earn interest on their crypto holdings. By depositing digital assets into a Nexo account, users can earn competitive interest rates, which are compounded daily. This feature is ideal for those looking to grow their crypto portfolio passively.

Nexo Card

The Nexo Card offers a seamless way to spend crypto assets in everyday transactions. This crypto-backed credit card allows users to make purchases and withdraw cash while earning rewards and cashback. The card is widely accepted and provides a practical solution for using crypto in daily life.

Exchange Crypto

Nexo Pro

Nexo Pro allows users to trade crypto at the best possible prices.

Nexo Booster

Nexo Booster allows users to use their current holdings and buy up to 3 times more of their favorite digital assets by financing the acquisition through a crypto-backed credit.

Nexo Wallet

Security Measures

Security is a top priority for Nexo. The platform employs a range of security measures, including insurance coverage for digital assets, advanced encryption, and multi-signature wallets. These measures ensure that user funds are protected against theft and cyber threats.

Additional Features

Nexo also offers a variety of additional features, such as portfolio tracking, detailed financial reports, and integration with other financial tools. These features enhance the user experience by providing comprehensive insights and easy management of crypto assets.

Market Dashboard:

User Experience and Interface

Nexo is designed with user experience in mind, offering a platform that is both intuitive and functional. Here’s an overview of what users can expect from Nexo’s interface and overall user experience:

Platform Usability

Nexo provides a user-friendly interface that simplifies the management of cryptocurrency assets. Whether you’re accessing the platform via a web browser or through the mobile app, the navigation is straightforward. Key functions, such as managing loans, tracking interest earnings, and accessing account information, are easily accessible with just a few clicks or taps.

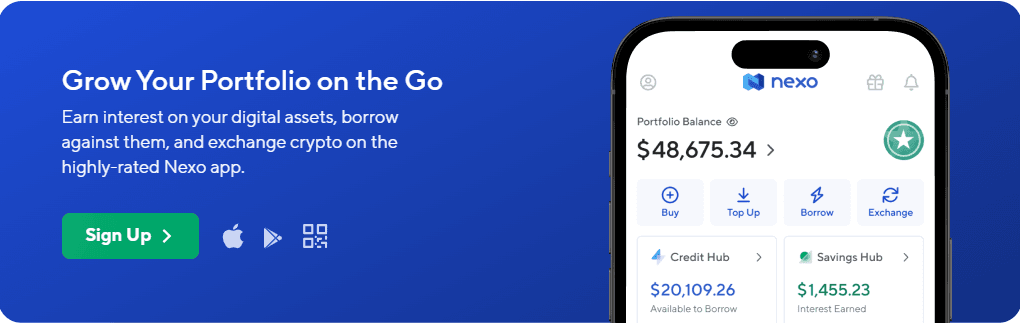

Mobile App Functionality

The Nexo mobile app extends the platform’s ease of use to smartphones and tablets. Available for both iOS and Android, the app maintains the same level of functionality as the desktop version. Users can perform transactions, monitor their portfolio, and access customer support directly from their mobile devices. The app’s design is optimized for a smooth experience, with clear menus and responsive controls.

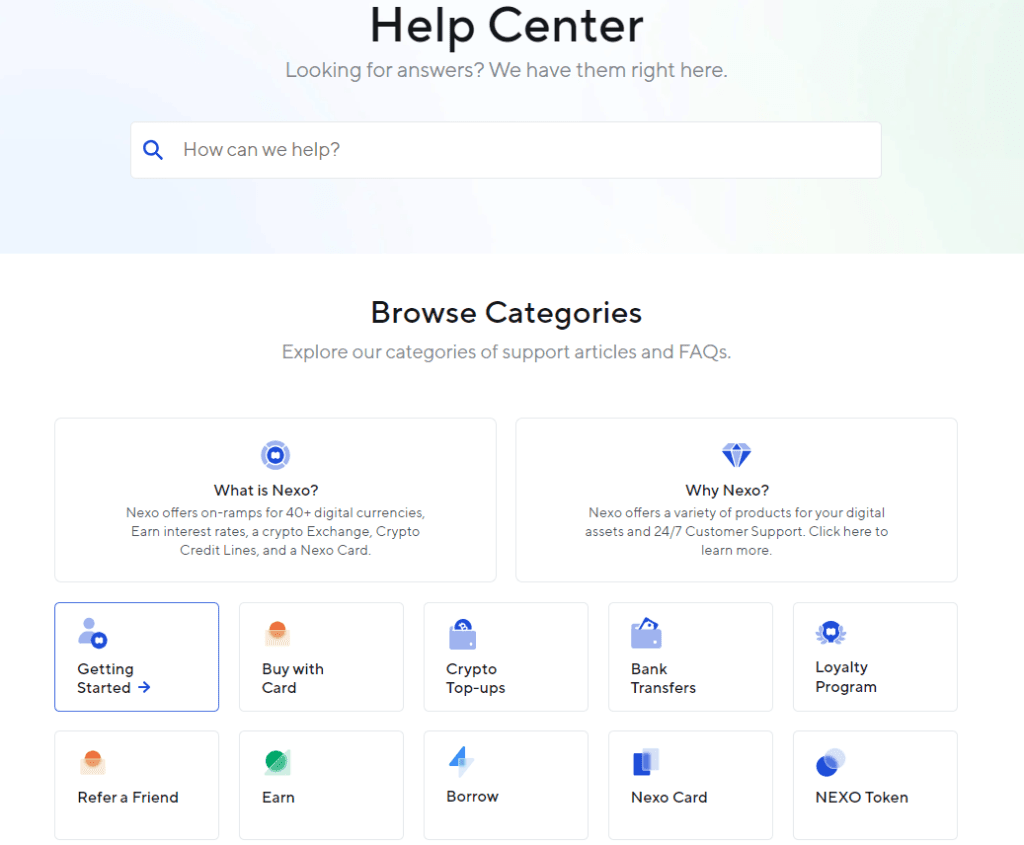

Customer Support and Resources

Nexo offers robust customer support options to assist users with any issues or questions. The platform includes a comprehensive help center with FAQs, tutorials, and guides. Additionally, users can contact support via live chat, email, or phone for more personalized assistance. This level of support ensures that users have the resources they need to navigate the platform effectively.

Visual Design and Aesthetics

The visual design of Nexo’s platform is clean and modern, with a focus on simplicity and ease of navigation. The use of clear fonts, intuitive icons, and a streamlined layout helps users quickly find the information they need. This design approach enhances the overall user experience by reducing complexity and improving accessibility.

Pricing and Fees

When evaluating Nexo, understanding its pricing and fee structure is crucial for assessing the overall cost-effectiveness of the platform. Here’s a detailed look at the fees associated with using Nexo:

Loan Fees

Nexo’s crypto lending service allows users to borrow funds using their cryptocurrency as collateral. The fees for taking out a loan include interest rates on the borrowed amount, which are competitive compared to traditional financial institutions. Interest rates can vary based on the type of loan and the cryptocurrency used as collateral. Nexo also charges a one-time setup fee for loan processing.

Interest Earning Fees

When users deposit their crypto assets into a Nexo account to earn interest, there are no hidden fees. Nexo pays out interest on a daily basis, and the rates are clearly stated. However, it is important to note that interest rates can vary based on market conditions and the specific cryptocurrency being deposited.

Nexo Card Fees

The Nexo Card, which allows users to spend their crypto holdings, may come with certain fees. These can include annual fees, foreign transaction fees, and ATM withdrawal fees. The exact fee structure is outlined in the card’s terms and conditions, and users should review these details to understand the costs associated with card use.

Other Fees

Nexo may also charge fees for specific services, such as expedited processing or currency conversion. These fees are typically outlined in the platform’s fee schedule and are designed to cover additional costs incurred by Nexo.

Comparison with Competitors

When comparing Nexo’s fees with those of its competitors, the platform generally offers a competitive fee structure. It’s beneficial for users to review the fee schedules of other crypto finance platforms to see how Nexo stacks up in terms of cost-effectiveness and value.

Pros and Cons

When considering Nexo, it’s essential to weigh its advantages and potential drawbacks to determine if it meets your needs. Here’s a balanced look at the pros and cons of using Nexo:

Pros

- Diverse Services

Nexo offers a comprehensive range of services, including crypto lending, borrowing, interest earning, and a crypto-backed credit card. This variety allows users to manage their digital assets efficiently and access liquidity without selling their holdings. - Competitive Interest Rates

The platform provides attractive interest rates on crypto deposits, allowing users to grow their assets passively. These rates are competitive within the industry and offer a significant advantage for those looking to earn on their crypto holdings. - User-Friendly Interface

Nexo’s platform is designed for ease of use, with a clean, intuitive interface both on desktop and mobile devices. This makes managing crypto assets straightforward, even for users who are new to the space. - Strong Security Measures

Nexo prioritizes security with robust measures, including insurance coverage for digital assets, encryption, and multi-signature wallets. This helps protect users’ funds from potential threats and breaches. - Quick Loan Processing

The platform offers fast processing times for crypto-backed loans. Users can access funds within 24 hours of loan approval, providing quick liquidity when needed.

Cons

- Fees for Certain Services

While Nexo offers competitive rates, some services come with fees. Loan processing fees, card fees, and potential currency conversion costs can add up, impacting the overall cost-effectiveness for users. - Variable Interest Rates

Interest rates on crypto deposits can fluctuate based on market conditions. This variability might affect the predictability of earnings, which could be a concern for users seeking stable returns. - Limited Cryptocurrency Support

Although Nexo supports a broad range of cryptocurrencies, it may not cover every digital asset available in the market. Users with niche or less common cryptocurrencies might find limited options. - Card Fees

The Nexo Card comes with certain fees, including annual and transaction fees. Users should carefully review these charges to ensure they align with their financial goals.

Conclusion

In conclusion, Nexo presents a robust and versatile platform for those looking to leverage their cryptocurrency assets. With a comprehensive suite of services including crypto lending, borrowing, and earning interest, Nexo caters to a wide range of financial needs. Its user-friendly interface and strong security measures further enhance its appeal, making it a reliable choice for both new and experienced users in the crypto space.

While Nexo offers many advantages, such as competitive interest rates and quick loan processing, it is important to be aware of potential drawbacks. Fees for certain services, variable interest rates, and limited cryptocurrency support may impact your overall experience. Understanding these factors will help you make an informed decision about whether Nexo aligns with your financial goals.

Overall, Nexo stands out as a leading platform in the crypto finance sector, offering innovative solutions and solid security. By weighing the pros and cons, you can determine if Nexo is the right fit for your needs and make the most of its offerings.